There is excellent news for property buyers in Spain this week. Read the latest on lower Spanish taxes, stronger protection for buyers and ever cleaner beaches. And if you’re tempted to buy a Spanish home, check out a bargain on a celebrity couple’s rather special home in Mallorca too! If you’ve got a spare €30 million that is…

Lower taxes in the sunny south

The lure of a new life in the Costa del Sol just got even stronger, following the introduction of new regional tax rules. Reduced rates of income tax, succession tax, transfer tax and stamp duty are being phased in this year in Andalusia. This is Spain’s most southerly region and includes the Costa del Sol, Costa Almería and Costa de la Luz. The changes spearhead efforts by the Andalusian regional government to become the lowest taxed region in Spain.

All this and lower taxes too! Malagueta on the Costa del Sol

Looking closer, regional income tax rates in Andalusia for 2019 will range from 9.75% for income up to €12,450, to 24.9% for income over €120,000. Reducing over coming years, by 2023 the lowest rate will be 9.5% and top rate 22.5% for income over €60,000, abolishing the €120,000 band.

The changes will not affect the state income tax rates.

Turning to succession (inheritance) tax, a new 99% tax relief is now available for spouses, descendants and ascendants, once any tax rates and multipliers have been applied for inheritances. And for the first time ever in Andalusia, the same level of relief is now being offered for lifetime gifts.

To help young and disadvantaged people get on the housing ladder, Andalusia is offering reduced rates for transfer tax and stamp duty for residents who are under 35 and those with disabilities or large families.

Meanwhile, the rates of tax for personal pension income and investments has been cut, and wealth tax is set to disappear completely in 2020.

Spain Property Guides can put you in touch with recommended property lawyers, estate agents and financial specialists in Spain. To be put in touch with the experts you need, click here.

Michael Douglas’s personal touch to property promo

One of Mallorca’s most famous homeowners, Oscar-winning film star Michael Douglas, is drawing on his own vocal talents to try and secure a property buyer in Spain for his lavish home on the island.

In his celebrated raspy tones, Douglas provides the narration to a new promotional video about his historic S’Estaca estate. It is between the villages of Deià and Valldemossa on the island’s north-west coast.

The 77-hectare property is on the market with Engel & Völkers for a €28.9million. If that seems like a hefty price tag, it is considerably less than the asking price of €55million when he offered it for sale in 2014! Don’t feel too sorry for Douglas though. He bought it S’Estaca in 1990 with his ex-wife for around €3.5million. Since marrying Catherine Zeta-Jones, the Wall Street and Basic Instinct star has visited less frequently.

So what’s the appeal? “In the mid-19th century, Archduke Ludwig Salvator of Habsburg bought a large piece of land on the northwest coast of the island of Mallorca, and began to create a magical retreat,” enthuses Douglas in the video. He reveals how he too “fell under the spell” of the isolated paradise and is now inviting a new owner to enjoy this magical property.

Overlooking the Med amongst Mallorca’s Tramuntana moutains, living accommodation at S’Estaca comprises a main white manor house surrounded by six other lodges. Facilities include a gym, spa, home cinema, wine cellar, private pier, Mediterranean gardens, olive groves and a vineyard. Suddenly €28.9million looks like a bargain!

Law shifts to favour mortgage borrowers

Getting a Spanish mortgage is now cheaper, more flexible and comes with better protection thanks to changes in the law that came into effect in June.

Spain’s new mortgage law (La Ley Hipotecaria) is good news for property buyers in Spain who need to borrow. It gives lenders less power to charge additional fees and tie in customers to other products. Key points of the new law include:

- Borrowers are now obliged to pay only an arrangement fee and valuation cost. Lenders or banks must now pay all other costs associated with a mortgage application, including stamp duty (AJD) and fees for the gestoría, notary and land registry.

- To improve protection and ensure borrowers are fully informed, lenders must provide more detailed information sheets (called FEINs) outlining the terms of their mortgage offer. They are also obliged to give customers a cooling off period of at least 10 days before they commit to a mortgage offer. Before signing the mortgage deed, the borrower must now make an extra visit to the notary without the lender during which the notary will test the borrower to check they understand the mortgage terms offered to them.

- Lenders can no longer insist that customers buy additional financial products, so-called tie-ins, such as life insurance, buildings insurance (which remains a legal requirement from an approved provider), pension products or credit cards. Lenders wishing to promote these products must provide two versions of a mortgage deal – one with the products, the other without.

- Early repayment fees have been reduced and are now capped, while floor clauses have been banned completely. In addition, the new law imposes more transparency on advertised APR (TAE) rates and has shifted the rules governing repossessions in favour of borrowers.

If you need finance for a property in Spain, or just a few tips on making your assets work harder for you, read How to Pay for a Spanish property.

Clean sweep for Spanish beaches!

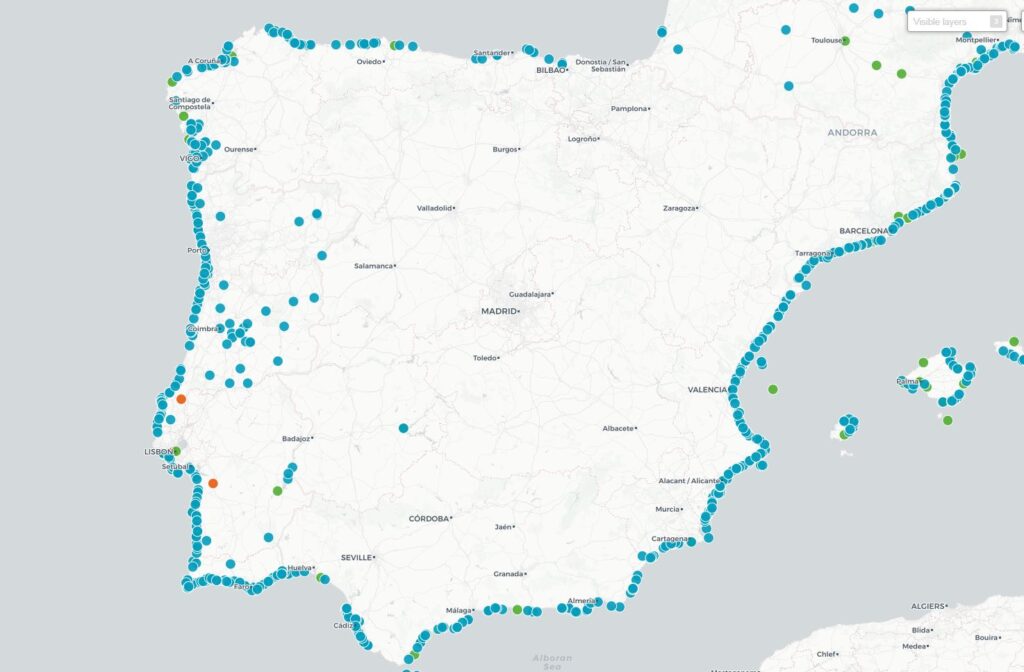

More good news for property buyers in Spain. The country has cleaned up in the race to have the highest number of quality beaches. Spain’s costas have earned a total of 669 Blue Flags. It’s not just the beaches either. Nearly 100 marinas five ports won also won flags – also ahead of any country – as well as the 566 beaches.

The Blue Flag awards recognise “pure water, clean coasts, safety and access for all.” Spain has for many years led the world in terms of delivering on these fronts and 2019 is no exception.

Crunching the numbers further, one in five of Spain’s beaches is Blue Flag. The Valencia region, home to the Costa Blanca, has the highest number with 135. Galicia in the north-west has the second highest number (107), followed by Catalonia (97), home to the Costa Brava, and then Andalusia (79), home to the Costa del Sol.