The American property market recorded a steady rise across the country in 2016, but which states saw 10% plus property price increases?

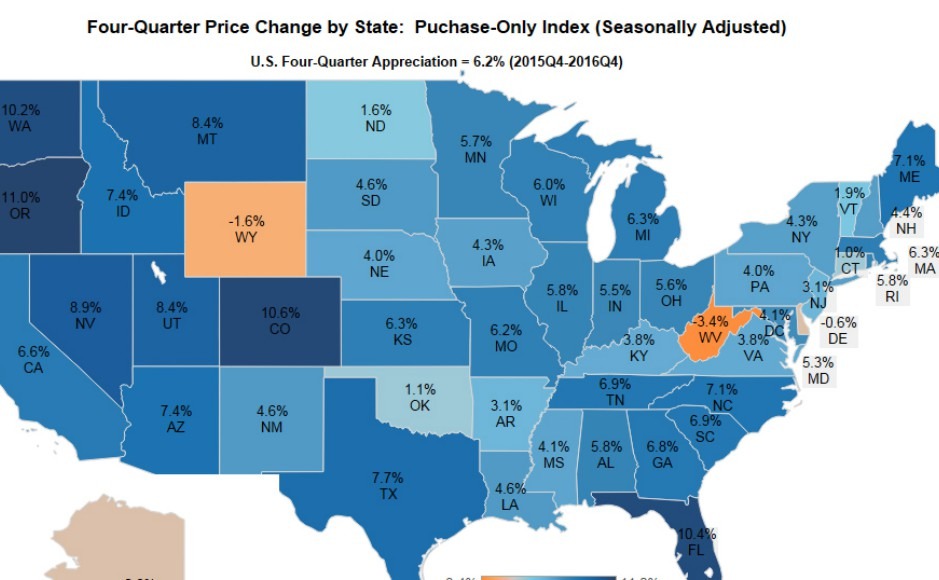

Property prices in the US rose by 1.5% in the final three months (Q4) of 2016, according to the Federal Housing Finance Agency. This continued the pattern of the previous nine months, amounting to a rise of 6.2% in the year.

The states that saw the biggest increases were Oregon, with 11%, Colorado 10.6%, Florida 10.4% and Washington state 10.2%.

The states that saw the biggest increases were Oregon, with 11%, Colorado 10.6%, Florida 10.4% and Washington state 10.2%. There was a bit of a drop to the fifth highest price rises, Nevada with 8.9%. The success of the north-western states (with the notable exception of Wyoming, one of only four states where prices fell) reflects the combination of the Pacific North-West’s economic success and friendly, small town ambience.

Trump tower? US property price rises accelerated in the final months of 2016

At a more detailed level, of all the metropolitan (city) areas in the USA, the Tampa-St. Petersburg-Clearwater area of western Florida saw the biggest price increase, at over 13%. Florida had several metro areas that performed well in price terms, especially Jacksonville, where prices rose by 12% last year, the Sarasota-Bradenton area (11.4%) and Miami Beach (10.8%).

Find homes in the USA via our property portal.

Mortgage rates rise

The average loan amount for January was $305,400, which is a drop of $13,700 on December

The FHFA House Price Index extrapolates price data from mortgages that are guaranteed by the Federal National Mortgage Association. The surprise was that these price rises were at a time when new mortgage contracts across the United States showed a marked increase in rates. The effective interest rate across all mortgage loans, adding in all additional fees and charges, rose from 3.99% in December, to 4.30% in January – a hefty increase. The average loan amount for January was $305,400, which is a drop of $13,700 on December.

Property price rises and falls by state in 2016

FHFA Deputy Chief Economist, Andrew Leventis commented: “Although interest rates rose sharply during the fourth quarter, our data shows no signs of a home price slowdown. Although it will certainly take more time for the full effects of the elevated interest rates to be felt, there is no evidence of a normalisation in the unusually low inventories of homes available for sale, which has been the primary force behind the extraordinary price gains.”

Download your free USA property guide

Our guide to buying a house in America is readily available online, but you can also a PDF version to view when you're offline or print. Simply fill in the form to the right and you'll be able to download your free copy.

- Ask the right questions

- Avoid the legal pitfalls

- Find your property

- Avoid losing money

- Move in successfully